#5 Compound Interest, the Most Powerful Force in the Universe 💪🏼🌌

The butterfly that caused a storm on the other side of the world

To Infinity and Beyond

You might have heard that compound interest is the strongest force in the universe. It is attributed to Einstein, although it’s not proven to be something that he said. More likely to have been somebody in the pre-Twitter age who wanted to lend credibility to their idea.

Anyway, this doesn’t detract from the fact that compound interest is an incredibly powerful tool when it comes to building wealth. And that’s why we’re here right? To figure out what steps we can take to build sustainable wealth.

Compound interest is actually perfectly logical. The problem is that we have little grasp of exponential growth. Our brains function much better when we look at linear growth. That’s why we struggle to comprehend that folding a piece of paper in half 42 times will reach further than the Moon…

The first time I saw that, I struggled to believe it. “How could that possibly be true?” I thought. But then I started to look behind the curtain and understand exponential growth more.

You see, the crazy thing about exponential growth, is that if you keep repeating an action, no matter how small that action is, it creates such momentum that the end result is far beyond anything you could have imagined.

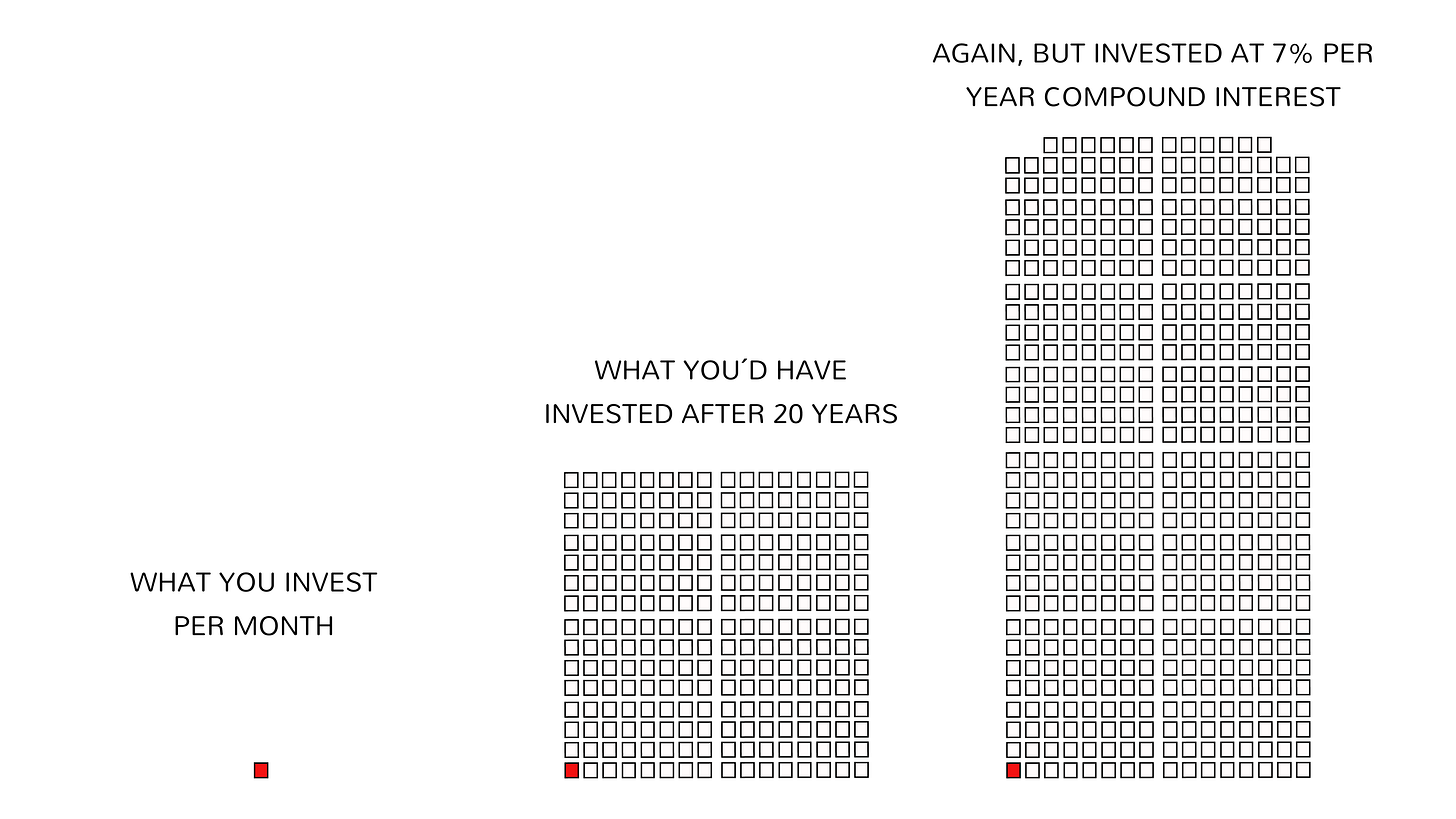

Let’s take a look at this from an investing perspective 👇🏼

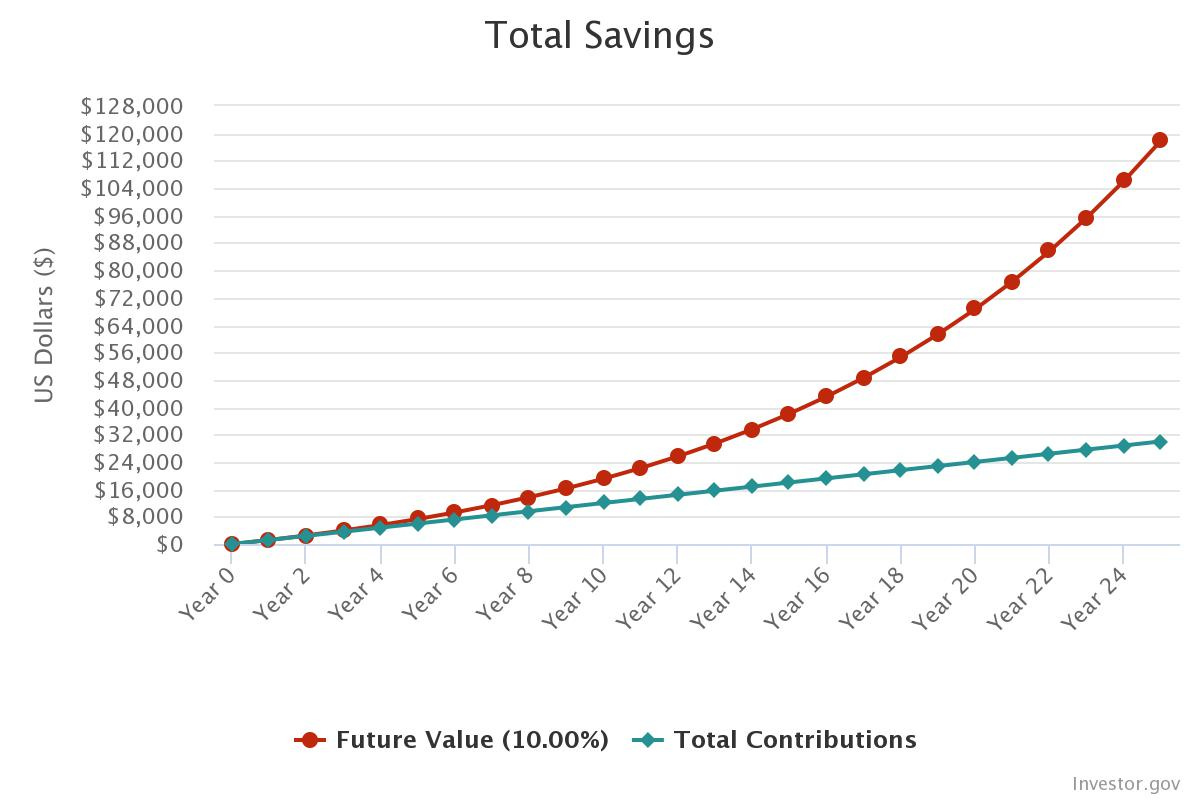

This is a simple calculation that shows the effect of compound interest. (The graph is in USD but luckily the rule applies in all currencies 😉)

In investing, this effect is achieved through dividends, which are payments made by companies as a thank you for holding their stock. You can (and should) reinvest these dividends back into the market. This is the “interest” where shares are concerned.

The interest you earn is added to your contributions. The year after that, interest is a percentage of your contributions plus last year’s interest. You earn interest on the interest. The year after, same again. You earn interest on the interest on the interest.

And so on, and so forth.

As time passes, the effect becomes impossible to ignore. The graph shows monthly contributions of £100 and a yearly return of 10%, which is the average annual return on the US stock market over the last 30 years. It shows that, despite the fact that you’ve only put in £30k of your own money, your account shows £118k. The rest is from compound interest.

The interest you receive earns interest. It’s a snowball effect.

The best thing is that it will only continue to grow faster and faster, while you keep putting the same amount in every month.

As Benjamin Franklin once said “Money makes money. And the money that makes money makes more money”. From an investment point of view, this could be considered the Holy Grail!

Now, let’s assume that instead of for 25 years, you invest for 35 years. You might think you maybe have a third more money, perhaps about £160k-£170k.

Luckily for us, you’d be wrong.

The actual answer is £325k.

Now the avalanche is really moving at speed, and the dividends you receive each year are far beyond that of your own contributions of £100 per month.

Let’s go crazy and say you leave the money investing for 45 years, from when you’re 20 to when you retire at 65 (if that’s still even possible when we get to that age!)

Imagine that it increased to £500k! After all, it’s only another 10 years…

However, this is when the investment pot is growing fastest. It grows by more and more each year. The avalanche is most powerful as it nears the bottom of the hill.

After 45 years, instead of £500k, you’d actually be more likely to have £860k!

And exactly how much of that is money you’ve contributed?

£54,000.

I’m going to leave a space to let that sink in…

When effectively employed and managed, nothing will work harder for you than your own money.

And if, heaven forbid, you continued investing £100 per month for just 2 more years?

Your portfolio would grow another £200k and put you squarely in millionaire territory.

All off the back of £100 a month.

The key takeaway from all of this is that if you’re not investing, you’re missing out on the greatest wealth building tool there is.

And although you would have much better returns if you had started 10 years ago, you literally cannot afford to waste any more time in starting.

The longer you can let it run, the more massive the results will be.

You see, the thing about compound interest is that, at the beginning, the effects are negligible.

They’re not exciting, and they don’t impress that person you’re chatting up at the bar.

But just as you didn’t like wine or coffee the first time you tried it, give it some time.

I can assure you; the results will be pleasantly surprising.

Just a quick note before I disappear! 🙏🏼

I create these newsletters to talk about subjects I find interesting, and I think that we would all benefit from learning more about.

However, what I’d love even more than likes, comments and new subscribers is to hear your feedback.

Seriously, nothing would make me happier than to know what you liked, what you didn’t like, what topics you’d like to see in the next one. Feel free to drop me a line at hello@stoicwealth.co.uk or send me a message here, and I’ll be sure to get back to you.

Or if you’re happy just as it is, hit the like button so I know I’m not barking up the wrong tree…

See you all in the next one!

Felix