#3 Wealth Creation Systems 🚀💷

How half an hour of effort can save you days of your life and make you wealthy too.

Hello, and welcome to the next edition of Tenets of Stoic Wealth. 😊

The aim of this newsletter is to build on some of the ideas relating to personal finance that I talk about in the visuals that I share on Twitter, LinkedIn and Instagram, while allowing space to get into more detail about how you can apply it to your own life.

This is not financial advice. It’s simply somewhere to learn about personal finance in a different and (hopefully 🤞🏼) more interesting way.

After all, it’s far too important a topic to leave to chance!

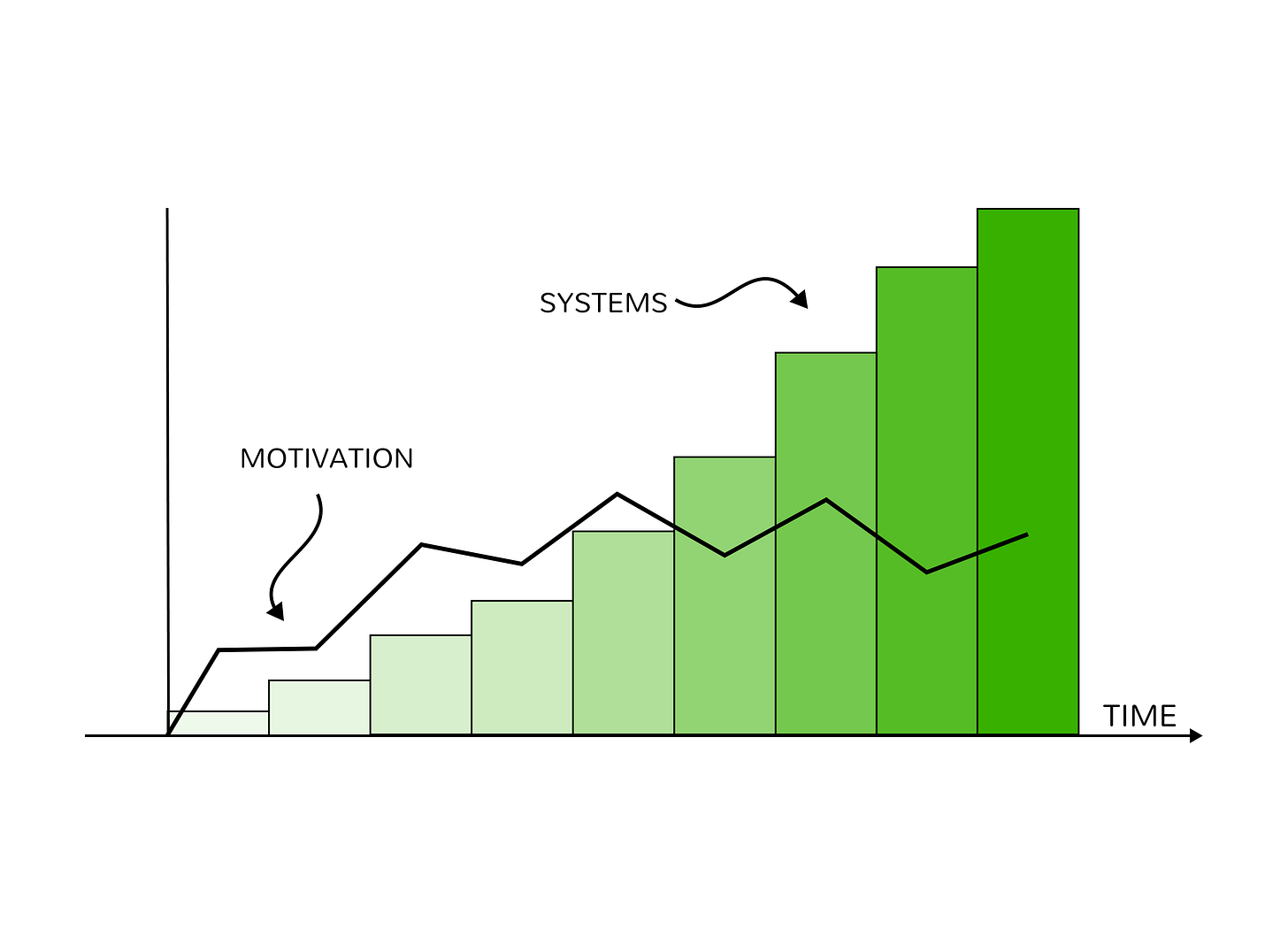

The Compound Benefit of Automated Systems

In both of the last two editions of this newsletter, we’ve touched on the idea of automated systems, and how they are useful in creating long term wealth.

Today we’ll look at this in more detail and see how spending 30 minutes creating some personal finance systems in your life will not only save you literal days of your life, but how they can make you wealthy as well.

Sounds too good to be true, right? Wrong.

Let’s take a look! 👇🏼

Humans are lazy and forgetful. Let’s be honest, if it takes too much effort on our part, most of the time we’re not interested. We forget birthdays, which day of the week it is, and occasionally to feed the cat. How on earth can we remember to pay off credit cards, put money into savings accounts, invest in the market and track our expenses as well?

Enter automated systems.

An automated system completes the action for you. That way, even if you are off hiking in the mountains, learning French, or looking for Nemo while scuba diving (all hobbies of mine by the way!), your systems are taking care of your finances.

Systems remove the human element from decisions and actions, which is just as well, because we’re usually the reason that something doesn’t happen!

Here are some systems you can apply. ⬇️⬇️

The Credit Card System

As we saw in the last edition about credit-cards (click here), we want to avoid paying the interest at all costs, but we also want to avoid late fees.

We can kill two birds with one stone here. Setting up your credit card so that it is automatically paid off by your current account means that you NEVER have to physically pay a credit-card bill again. You literally cannot pay late, and as long as there is the money in your current account to pay the bill in full (which should absolutely be the case) then you will never pay interest either.

The credit card company sends a payment request to your bank account. Your bank account pays the credit card bill.

All while you’re watching England play in the World Cup. ⚽

Automatic Saving

When you receive your paycheck, it’s all too easy to say, “I’m going to save what’s left at the end of the month.”

The problem is, we don’t do that. It’s much more gratifying to spend that money on something rather than putting it into our savings.

Systems to the rescue again.

Set up a direct transfer from your current account to a savings account for when you receive your paycheck. This way, automatically, a part of your paycheck is sent to your savings account, (this should be a different bank to make it less likely that you’ll be tempted to spend it)

Now, the money that you actually have in your account to spend is less. You’re playing a psychological trick on yourself by “removing” the money that you wanted to save in advance, before you accidentally spend it.

The beauty of this is you can adjust it to as much or as little as you want. Maybe £100 a month into your savings was easy. Why not try £200 next month?

Effective systems = wealth creation.

Automatic Investments

The other two systems above will help you save money, while this system will build you long-term wealth.

Set up your current account to pay money each month into your brokerage account.

Set your brokerage account to automatically use this money to buy shares in a low-cost index fund each week or month.

Now, leave it alone.

Every month, you’ll be investing in the market. You’ll buy when it’s expensive, correctly priced or cheap.

Every. Single. Month.

This is known as Dollar Cost Averaging, and ensures that over time, you’ll average out the price that you invested at.

Automate your investing, so you can focus on living.

And it’s as simple as that.

You might remember to save money, pay your credit card bill on time or invest occasionally.

But putting systems in place means that those things happen every time.

Leaving you to get on with enjoying your newly found time, while your systems take care of your finances.

Now, where did I leave those hiking boots?

And that’s it for this edition of Tenets of Stoic Wealth.

I hope that you enjoyed it, and please feel free to share with any friends, family, third cousins and pets who may find it useful! You can do that here:

If you have any thoughts or feedback, I’d love to hear from you! You can either reply to me here or reach me by email at hello@stoicwealth.co.uk

See you all in the next one!

Felix