#4 Multiple Income Streams 📊

How they help you to avoid eating on the floor.

Hello, and welcome to this edition of Tenets of Stoic Wealth. 😊

The aim of this newsletter is to build on some of the ideas relating to personal finance that I talk about in the visuals that I share on Twitter, LinkedIn and Instagram, while allowing space to get into more detail about how you can apply it to your own life.

This is not financial advice. It’s simply somewhere to learn about personal finance in a different and (hopefully 🤞🏼) more interesting way.

Let’s dive into this week’s edition!

The Limiting Factor

So far on this personal finance journey together, we’ve looked at the importance of building an emergency fund, avoiding high interest debt like the plague, and the value of automatic financial systems.

All of these relate to saving money and making sure that you’re using the wealth you have as efficiently as possible.

But now it’s time to look at the other side of this coin…

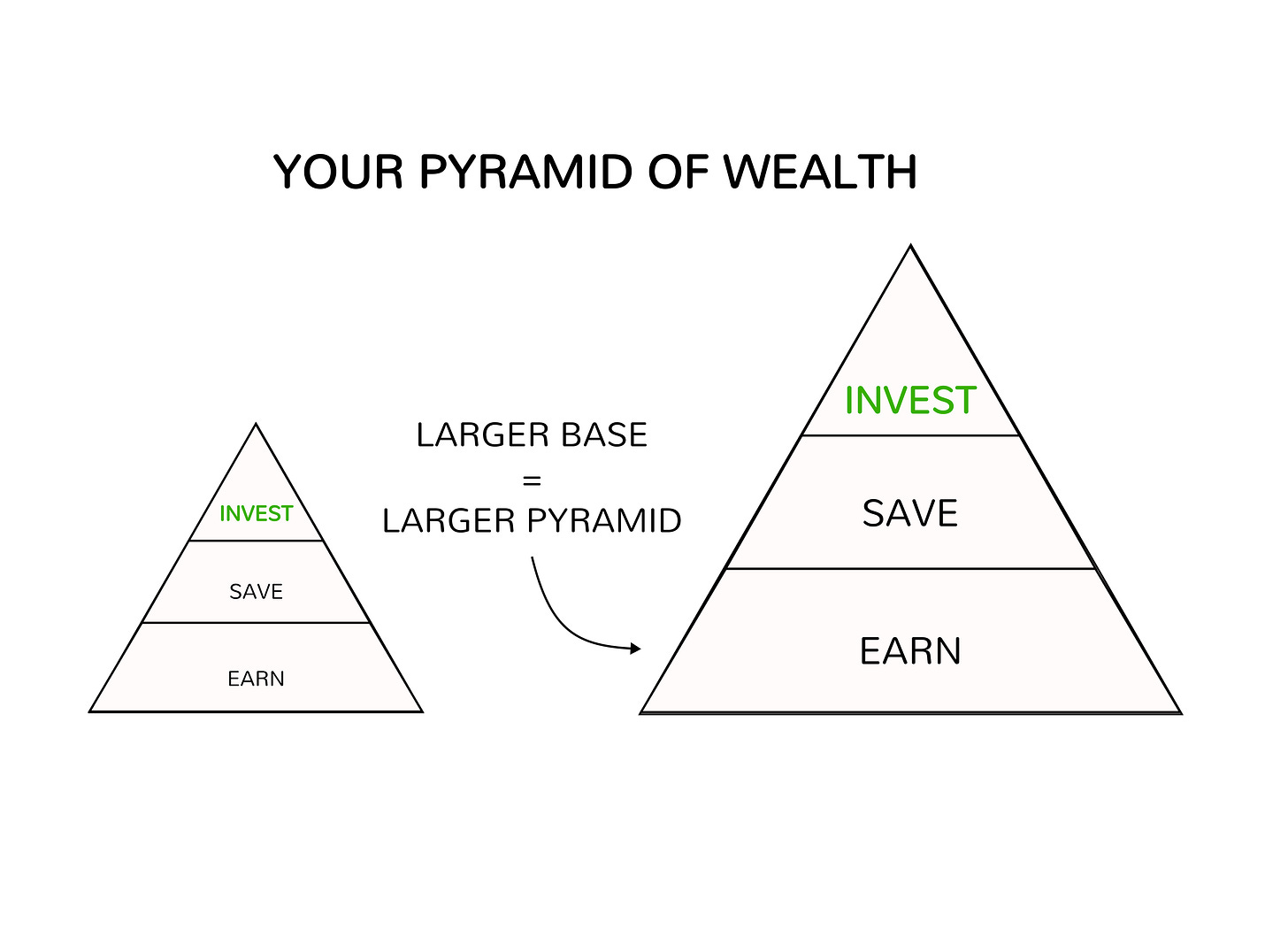

The Size of your Pyramid

It’s all well and good to maximise the return that we can generate from the money that we have, saving and investing as much as possible and reducing unnecessary expenses. But there’s a glass ceiling, a limiting factor that means that even if you didn’t have any expenses (certainly a cushy situation to be in!) you wouldn’t be able to improve further.

That limit is your earnings.

Earn more —> save more —> invest more.

You can’t invest and save money that you don’t have. It’s that simple.

We need to focus on building the base, in order to build a larger pyramid.

If you’re focused on reducing your expenses and optimising with the money that you have, that’s great, but you can only improve so much. There is limited potential upside, and you will only ever be able to improve within the limit of what you earn.

On the other hand, if you focus on increasing your earnings, you can easily double per month the amount that you can save or invest. This is because increasing your earnings has almost unlimited potential.

Let’s suppose you cancel all your subscriptions, walk to work and eat only white rice and vegetables whilst living in a shared house, and maybe you can add an extra £500 a month to your savings.

But if you can earn an extra £6k a year, you can increase your savings by the same amount while still maintaining your current lifestyle (which, being a reader of Tenets of Stoic Wealth, is obviously relatively frugal, but not excessively so!)

Therefore, the next thing that we need to focus on is increasing our income.

Adding Legs to your Table

You could ask for a pay rise, or consider changing jobs, and these are both good options. However, by having all your income come from a single source, you are ENTIRELY dependent on that job.

Just like the protection provided by your emergency fund, earning money from multiple different sources gives you much greater control over your financial situation. If you are suddenly made redundant, you don’t panic because it’s not your only way to earn money.

Multiple income streams increase your stability.

I can’t emphasise this enough.

Having different streams of income reduces your dependency on any one of them.

Wealth is freedom, and if we are tied to a job, then we are only living the illusion of freedom that a monthly paycheck creates.

The Benefits

Many alternative income streams can earn you money without you being actively involved. This is called passive income, and while it’s a topic in its own right, it deserves a mention here. This is true of dividend investing, online selling, rental properties (when managed by others) to name just a few.

It can also significantly boost your financial situation. You might be able to get a £5k annual pay rise at your job, but that hobby or bright idea could become a side hustle generating an extra £2k a month, straight into your pocket. The earning potential can be massive, and you maybe only need to invest a few hours a week on it.

It can also be an opportunity to try out a new idea and learn new things. You get to beta test business ideas while maintaining the stability of a regular job.

All this without including the peace of mind that having multiple income streams provides you. You don’t have all your eggs in one basket.

You know that if suddenly you no longer had your job, then you would still be able to put food on the table.

Wealth is about building long term financial stability.

If you lose one leg of the table, it will still stand, (albeit slightly wonkily!)

If you lose the only leg of the table, well, you’ll be eating on the floor.

Adding more sources of income leads to greater financial stability.

And that’s it for this edition of Tenets of Stoic Wealth.

I hope that you enjoyed it, and please feel free to share with any friends, family, third cousins and pets who may find it useful! You can do that here:

If you have any thoughts or feedback, I’d love to hear from you! You can either reply to me here or reach me by email at hello@stoicwealth.co.uk

See you all in the next one!

Felix

Great post! Congrats