#6 Inflation, the Assassin of Wealth 🔪

What is it, and how can we fight against it.

Inflation.

It’s all over the news, people are complaining about it on the Tube, and you’re seeing pictures of Germans burning cartloads of worthless cash after WW1 because it made more sense to do that than use it to try and buy anything.

But what actually is it, and how does it affect us?

Reduced down to its simplest terms, inflation refers to the rising cost of goods, and the weakening of your purchasing power.

Even more simply put, your money no longer buys as much as it once did. Your weekly shopping used to cost £50 and now it costs £80 for the same things. You’re likely still earning the same wage. Your money is simply worth less as every year passes.

The reasons for inflation are many, and not something that we need to worry too much about at the moment in this newsletter. Governments create an excess of cash, which therefore makes everyone’s money worth less. Combined with supply chain issues, this double-edged sword means that prices are rising due to demand, at the same time as your money is becoming worth less.

“You’re telling me!” you splutter, as you fail miserably every time you try to guess how much your weekly shopping will cost at the checkout (Nobody else play that game? Ok, just me then!)

But now that we know what inflation is, what can we actually do about it?

The short answer is nothing.

However, that doesn’t mean you can’t be proactive in how you take care of your personal situation.

Because of inflation, holding cash means that the value of your money is going down all the time. At the end of the year, you can buy less with the same amount.

This isn’t to say that you should invest it all into some obscure cryptocurrency or burn it as fuel like the Germans did (although with the prices of gas recently, I wouldn’t blame you!) because you always need to keep some cash on hand (see previous post about emergency funds). But cash is NEVER going to grow in value when simply left in a bank account.

That’s why we need to look to investing.

Historically, over the mid to long term, investing will always provide a greater return than inflation will a negative one.

If you leave cash in the bank, you might get a little bit of interest added at the end of the year, as a thank you from the bank for letting them lend out your money to other people (that’s a whole different sub-topic!) But if you get 1% interest while inflation is at 5%, then you’ve realistically lost 4% of the value of your money, even though the actual number in your bank account may have actually gone up.

This is why inflation is so dangerous, because it’s not obvious. If your bank account was losing money every day, you’d notice. But as the money you have stays the same, you’re not actually “losing” anything and therefore you are much less likely to realise. Until suddenly nothing costs a pound at Poundland anymore…

Therefore, investing in assets is the most reliable way to reduce the negative effects of inflation. As the price of assets to go up, your wealth will increase, in line with or exceeding the rate of inflation.

In stark contrast, anything that you leave in the bank will continue to be worth less, year after year.

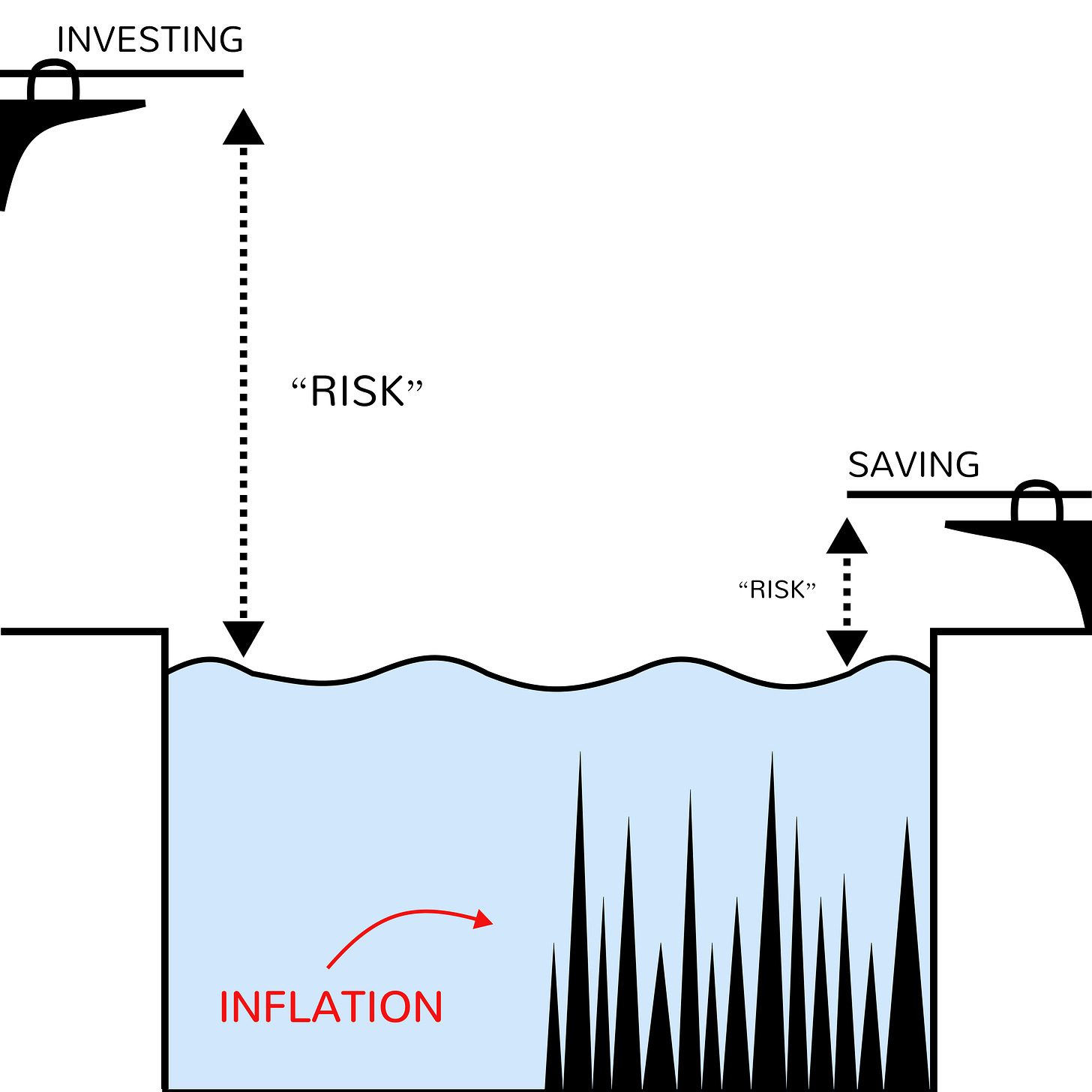

Investing may look like the “riskier” option at first sight, because your investments can go down as well as up. With savings, you can be guaranteed that the money in the bank is still going to be sitting there when you go back to it.

But what we don’t see is the effect of inflation on that money sitting in the bank account, which makes this option much more dangerous. You may not lose money in the sense that the number value of the cash in your account stays the same, but every year you can buy less and less with it…

This is why you cannot save your way to wealth, because the money you save now may only buy you a 10th of what it buys you at the moment.

Compound interest works fantastically for your wealth creation, but it also applies to the rate of increase in your expenses. If you’re not actively growing your wealth, then your expenses will end up costing you more and more each year, and you’ll be unable to pay them if you rely just on savings.

In short, you need to make sure that you are investing in order to stop your wealth being reduced by inflation.

The simplest way of doing this would be through an index fund, buying shares.

However, any example of where you are putting your money to work for you will mean that it is doing something productive, rather than sitting in your bank account being eaten away.

Having some cash is important, both as savings and an emergency fund.

But don’t be fooled into thinking that it’s the same as wealth.

You simply cannot build long term wealth without investing your money.

So, what are you waiting for?

Put it to work!